Getting a cosigner on your student loans can make it possible for you to qualify for a lower interest rate than you would on your own.

But for your cosigner, the loan shows up on their credit report as if it’s their own, increasing their debt-to-income ratio and potentially making it difficult for them to get credit for themselves. What’s more, they’re equally responsible for paying back the loans, which can cause trouble if you’re struggling to keep up with payments.

Fortunately, it’s possible to release your cosigner from their obligations. Here’s what you need to know.

How to remove a cosigner from a student loan

You have two simple options if you’re looking to tweak your cosigned loans.

- Apply for a student loan cosigner release

- Refinance your student loans

1. Apply for a student loan cosigner release

Some private student loan companies offer a cosigner release program, that allows you to keep your loans and remove your cosigner.

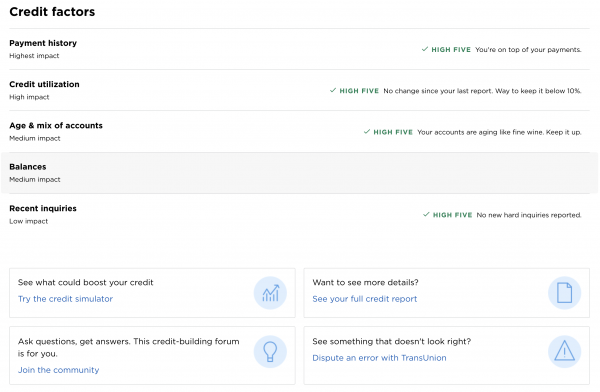

The requirements to qualify for cosigner release can vary. But in general, you need to make a certain number of consecutive on-time payments, then undergo a credit history review. If you meet the lender’s criteria, your cosigner will be removed and you can continue making payments as the sole borrower.

The process for applying for co-signer release depends on the lender. Call your lender directly to understand the steps and how long the process takes.

Unfortunately, cosigner release programs can be difficult to qualify for. According to a 2015 report by the Consumer Financial Protection Bureau, 90% of borrowers who applied for co-signer release were rejected. That said, if you’ve worked on growing your income and improving your credit, you may have a good chance of removing your cosigner, relieving them of their obligation and the credit implications of being on your loans.

2. Refinance your student loans

If your lender doesn’t offer a cosigner release program or you haven’t met the payment requirements, consider refinancing your student loans instead. The credit requirements will likely be similar to a cosigner release program because, in both instances, the lender wants to ensure that you can qualify on your own.

If you can qualify for a student loan refinance at a lower rate than you’re currently paying, there are often no downsides to refinancing. You can use Credible to compare student loan refinancing rates from multiple private lenders at once without affecting your credit score.

With refinancing, though, you may be able to take advantage of some other benefits that you can’t get with a cosigner release. In addition to releasing your cosigner from their obligations, refinancing can also make it possible for you to get a lower interest rate than what you’re paying now. This is especially possible if market interest rates have dropped or your credit and income have improved significantly.

Refinancing can also give you a little more flexibility with your monthly payments. For example, if you can afford a higher monthly payment, you may choose a shorter repayment period and eliminate your debt early. Alternatively, if you need some room in your budget, you can request a longer repayment term, which makes your monthly payments more affordable.

See what your estimated monthly payments would be with a refinance using Credible, which allows you to compare rates from up to 10 student loan refinance companies.

However, refinancing isn’t for everyone. It can be difficult to get approved for favorable terms, especially if it hasn’t been long since you needed a cosigner for the original loans.

During the process, make sure you’re comparing apples to apples with fixed interest rates and variable interest rates. While variable rates start off lower, they can increase over time.If you’re considering refinancing your student loans, visit an online marketplace like Credible to compare lenders side by side. Simply share a little information about yourself and your student loans, and you’ll be able to view loan offers with just a soft credit check.

While you’re at it, use a student loan refinancing calculator to get an idea of different repayment options and how that impacts your monthly payments and total interest charges.

The bottom line

If you have a cosigner on your student loans, the faster you can release them from the debt, the better. Not only will it make it easier on them in terms of credit and financial obligations, but it can also relieve stress with the situation.

If you’re hoping to drop your cosigner from your loans, consider a cosigner release program or student loan refinancing. Both options have their benefits and drawbacks, though, so do your research to determine which path is the best for you.

And if you’re considering refinancing, make sure to compare student loan refinancing rates before you apply, so you can make sure you find the best deal for you.

Need Help?

If you still need help with controlling your debt and/or improving your credit, fill out the form below and get a free credit consultation from a credit expert at Better Qualified.